On May 2, 2024, the Internal Revenue Service (IRS) released an update on the Strategic Operating Plan, a detailed blueprint outlining future projects for the agency's transformation work, highlighting dozens of improvements for taxpayers since the enactment of the Inflation Reduction Act.

The annual report focuses on the major milestones achieved by the agency since the passage of the IRA in August 2022. This series of changes has enhanced taxpayer service, added fairness to tax compliance, and introduced new technological tools to facilitate taxpayers and tax professionals. These efforts culminated in one of the agency's most successful tax filing seasons, with significant improvements in taxpayer service and the introduction of new technological tools.

Key Objectives:

The report focuses on five key objectives:

- Dramatically improve services to help taxpayers meet their obligations and receive tax incentives.

- Promptly resolve taxpayer issues when they arise.

- Focus enforcement efforts on taxpayers with complex tax filings and significant violations to address the tax gap.

- Deliver cutting-edge technology, data, and analytics for more effective operations.

- Attract, retain, and empower a highly skilled, diverse workforce and develop a culture better equipped to deliver results for taxpayers.

Ongoing and Future Projects:

The report highlights several ongoing and future projects until fiscal years 2024 and 2025, including:

- Improving live assistance through enhanced efficiency in call centers, reducing backlog of paper returns, and increasing staffing levels in taxpayer assistance centers.

- Expanding online services by broadening features in online accounts, including digital notices, status updates, secure messaging, and payment options.

- Accelerating digitalization by providing over 150 non-tax forms in digital mobile-friendly formats in addition to the 20 delivered in fiscal year 2024.

- Simplifying notices by redesigning about 200 notices, capturing 90% of total notice volume for individual taxpayers.

- Modernizing foundational technology and obsolete programs from the point of acceptance of tax returns and information systems.

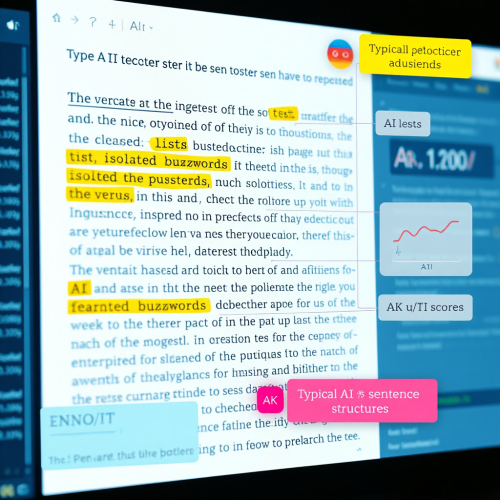

- Improving tools for IRS employees by developing and integrating priority software tools into operations.

Future Perspectives and Challenges:

IRS Commissioner Danny Werfel emphasized that despite significant progress made with IRA funding and under the Strategic Operating Plan, there is still much work ahead to continue transformation efforts. Additionally, the report highlights ongoing funding challenges.

The proposed budget for fiscal year 2025 by the administration aims to maintain full IRA investment in the IRS until 2034, avoiding drastic funding cuts that could compromise IRS work across various areas, including taxpayer services and technological modernization.

Conclusion IRS: Tax Transformation and Artificial Intelligence Implementation

The recent update to the IRS Strategic Operating Plan outlines an ambitious transformation path centered around the implementation of Artificial Intelligence (AI) to enhance taxpayer services and ensure effective tax compliance. The IRS is committed to leveraging AI to streamline operations, provide personalized assistance, and identify complex tax violations. This commitment reflects a vision of modernization that goes beyond mere technological updates, emphasizing greater efficiency and transparency in the tax system. The agency aims to become a model of excellence in AI usage in the public sector, contributing to a fairer and more efficient tax system for all taxpayers.

Info

Glossary

- IRS - Internal Revenue Service

- IRA - Inflation Reduction Act

- AI - Artificial Intelligence

- FY - Fiscal Year

- EIN - Employer Identification Number